Understanding your financial status can be daunting,, but it shoulshouldn’tOne vital parameter to consider is net worth, though it often remains an elusive concept for many. Welcome to our blog post, “Demy” notifying Wealth: How to Calculate Net Worth Like a Pro!”. De” mystifying this financial jargon, we will define net worth and unravel how to calculate it. This knowledge can provide a clear picture of your financial health and guide decisions toward wealth improvement. So please fasten your seat belts as we take you on a journey to a professional level of net worth calculations. It’s as complicated as it may seem!

I don’t know how to calculate net-worth but I make a lot of money, trust me. “@AmosParks5: CassperNyovest your net worth? #AskCassper”

— Don Billiato (@casspernyovest) November 25, 2014

Understanding the Concept of Net Worth

Net Worth is a key financial term that measures the financial standing of a company or an individual. The concept of net worth is relatively simple to understand- it is the difference between what you own (assets) and what you owe (liabilities). Essentially, an overview shot of your financial health at a given moment, calculated as Assets – Liabilities = Net worth.

Why is Net Worth Important?

Understanding how to calculate net worth is not just about knowing an n; member, but also about it’s understandinindividual’siduacompany’s financialncial health. Having significance doesn’t usually usually indicate a great financial situation if your liabilities are overwhelmingly high.

Understanding your net worth can help you make informed decisions about savings, investments, and debt reduction. Net worth is essentially a comprehensive gauge of financial well-being.

How to Calculate Net Worth: A Step-by-Step Guide

Calculating your net worth is simple when you break it down into steps:

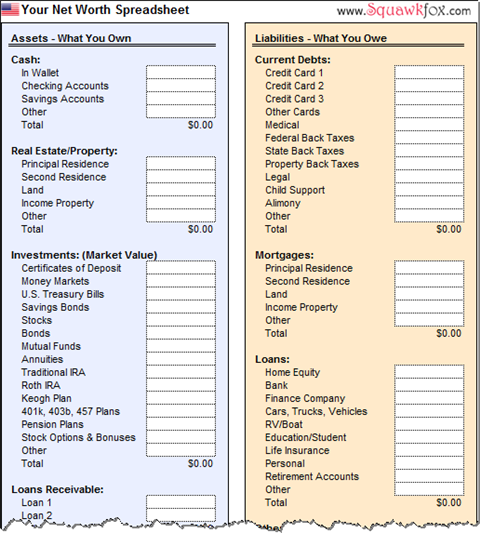

- First, make a list of all your assets. This could include property, retirement accounts, or commodities like art or jewelry.

- Next, add up all of your liabilities. Typical examples are mortgages, student loans, credit card debt, and car loans.

- Lastly, subtract the total liabilities from your assets to find your net worth. If this number is positive, you have a positive net worth. If not, your net worth is negative.

Keep in mind that an item’s true value is what someone would actually be willing to pay for it today, not what you paid for it originally.

The Importance of Calculating Your Net Worth

Understanding your financial health is crucial for making sound financial decisions or setting financial goals. One critical factor is knowing how to calculate your net worth. Your net worth is what you own minus what you owe. A snapshotpshot of your financial health at a specific point in time.

Why Calculate Your Net Worth

Measuring your net worth is like taking a financial self-portrait. It allows you to see where you currently are and plan where you want to go financially.

Regularly checking your net worth helps you monitor your financial progress, reassess your investments, and realign your financial goals.

How To Calculate Your Net Worth

To calculate your net worth, subtract your total liabilities (what you owe) from your total assets (what you understand with a simple equation: Net Worth = Total Assets – Total Liabilities.

- List all your assets, including cash, investments, real estate, vehicles, personal property, etc.

- List all liabilities, including mortgages, car loans, credit card balances, and student loans.

- Subtract the total liabilities from the total assets.

Identifying Your Assets: The First Step to Calculate Net Worth

Before understanding how to calculate net vital it’s vital to identify your assets, assets refer to everything you own that has a monetary value. They are essential in determining your financial standing, varying from real estate and vehicles to your savings and personal property.

Types of Assets for Calculating Net Worth

To accurately calculate your net worth, you need to consider all types of assets:

- Real Estate: This includes your primary residence, rental properties, vacation homes, or land.

- Vehicles: Cars, boats, motorcycles, and other forms of transportation.

- Investments: Stocks, bonds, mutual funds, retirement accounts, and other assets.

- Cash and Cash Equivalents: Savings, checking accounts, and physical cash.

- Personal Property: Jewelry, art, furniture, electronics, and other valuable personal items.

Accurately Valuing Your Assets

To calculate your net worth accurately, you must place a correct market value on these assets. Online valuation tools, local realtors, or vehicle dealers can provide current market values for real estate and vehicles. Investment accounts and cash equivalents provide their exact current value. Estimates can be made for personal property based on recent sales or appraisal values. Remember, overestimating the value of your assets will not provide an accurate picture of your net worth.

Finding Your Liabilities: The Other Half of the Equation

When calculating your net worth, liabilities are an often overlooked facet that can significantly impede your wealth-building journey. Liabilities, in layperson’s terms, represent what you owe others. This can range from consumer debt to mortgages and student loans.

Identifying Your Liabilities

To determine your liabilities, start by listing all personal debts, such as credit card balances, student loans, auto loans, and any other outstanding personal debts. Then, factor in larger liabilities, such as mortgages and business loans.

Once you understand your liabilities clearly, you are one step closer to determining your net worth.

Why Addressing Your Liabilities Matters

Liabilities are essential in the grand scheme of wealth creation, as they form the other half of the equation.

- Improve Credit Score: By managing and clearing your liabilities, you can significantly enhance your credit score.

- Better Financial Planning: Knowing your liabilities gives you a solid footing for financial planning and makes goal-setting more realistic.

- Increased Financial Freedom: Understanding and addressing your liabilities paves the way for financial freedom, ensuring you’ryou’re’weal’hy’ on ‘aper only.

Subtracting Liabilities from Assets: The Base Formula for Net Worth

When you want to understand how to calculate net worth, the basic formula you need is simple: Assets minus Liabilities, when calculating you are ‘reractingou’reracting what you owe from what you have.

Understanding Assets

Your assets include everything you own that has substantial value. This could be tangible things like houses, cars, and personal belongings.

Also included is your savings, investments, and retirement accounts. Remember, although your primary residence contributes towards your atypicallyt’stypically, something you would sell to settle debts.

Understanding Liabilities

Your liabilities, on the other hand, represent your debts or what you owe. These can be your mortgage, car loans, credit card debts, student loans, etc. It is important to remember that even small debts can add up and significantly impact your net worth.

- Mortgages

- Car Loans

- Credit Card Debts

- Student Loans

Calculating Net Worth

Finally, to measure your net worth, you subtract your liabilities from your assets. This gives you a number that represents your total net worth. Keep in mind that this number can be negative if you owe more than you own.

Examples of Net Worth Calculations in Real-Life Scenarios

Understanding how to calculate net worth can become much simpler when we apply this concept to real-life scenarios. Let’s provide some examples to illustrate this financial fo further.

Scenario 1: Young Professional

Mark is a young professional who started his career. He has some student loans, a modest income, and little to no physical assets.

Here’Here’swe might calculate Mark’Mark’sworth:

Assets: $10,000 (Savings) + $2,000 (Car)

Liabilities: $20,000 (Student Loan)

Net Worth: $10,000 + $2,000 – $20,000 = -$8,000

Scenario 2: Middle-Aged Entrepreneur

A middle-aged entrepreneur, Lisa, owns a successful business, a house, and has some debt. This scenario will reflect the complentrepreneur’seneur’sworth calculation.

- Assets: $500,000 (House) + $1,000,000 (Business value) + $50,000 (Savings)

- Liabilities: $100,000 (Mortgage) + $200,000 (Business Loan)

- Net Worth: $500,000 + $1,000,000 + $50,000 – $100,000 – $200,000 = $1,250,000

Tips and Strategies to Increase Your Net Worth

Accumulating wealth is a journey, and increasing your net worth is a crucial part of that process. Strategies for achieving this involve careful planning and execution. Below, we share up-to-date information on how to calculate net worth and optimize wealth growth.

Recognize and Evaluate your Assets

Begin by acknowledging all your assets. This includes tangible items like real estate, vehicles, and other valuables and intangible assets such as stocks, bonds, and savings accounts.

Once identified, ensure you calculate the current market value of these assets. This continually changes due to variables such as property appreciation/depreciation and market fluctuations. Stay updated!

Minimize Your Liabilities

After acknowledging your assets, it iessentialnt to focus on your liabilities. These are your debts and obligations, such as mortgages, student loans, credit card debts, etc. The key is to minimize these as much as possible.

Increase Your Income Streams

Establishing multiple income sources is a proficient way to increase your net worth. You can do this by building side hustles, pursuing freelance work, investing in stocks/bonds, and more.

- Remember, multiple incomes start as a safety net if one falls short.

Regular Monitoring of Your Net Worth

Lastly, track your net worth regularly. This will allow you to analyze your financial progress and identify areas requiring improvement.

Frequently Asked Questions

- What is net worth?

- Net worth is the value of all assets minus the total of all liabilities or debts. It can apply to companies, individuals, countries, or even sectors.

- Why is calculating my net worth important?

- Calculating your net worth is essential as it provides a snapshot of your financial health. Knowing your net worth can help you understand your current financial standing and plan for financial goals.

- What factors are considered when calculating net worth?

- All your assets (cash, investments, property, etc.) and liabilities (mortgages, loans, credit card debts, etc.) are considered when calculating net worth. The difference between your total assets and total liabilities equals your net worth.

- How often should I calculate my net worth?

- A common practice is calculating net worth annually. However, suppose you are actively improving your financial health or aiming towards specific financial goals. In that case, calculating it more frequently, such as quarterly or monthly, might be beneficial.

- Does a negative net worth mean financial trouble?

- A negative net worth indicates that your debts outweigh your assets. While idealidealdoesn’t usuallyameans mean financial disaster. It might be a sign to reassess your finances and make necessary adjustments to increase assets or decrease liabilities.

- Do I count depreciating assets like cars in my net worth?

- Yes, you should include depreciating assets in your calculations. However, consider their current value, not the price you originally paid.

- Should I incinclude it my net worth calculation?

- Yhomeme’se is typically an asset in your net worth calculation since it could be sold for cash. Use your homhome’s presentrket value, not just the purchase price or mortgage balance.

Crunching the Numbers: The Ultimate Takeaway

So there you have it – demystifying wealth is as simple as learning how to calculate net worth. As you have seen, understanding your net worth is not just about glancing at your bank balance; it demands more work. But by diligently considering all of your assets and subtracting your liabilities, you put yourself in drive driver’svers of your financial future. In closing, remember the reliable formula to calculate net worth: Assets minus Liabilities equals Net Worth. Yoequippedipped to estimate your net worth a lik pro, and make judicious financial decisions.