Googled myself and found my networth. Where is the lie? 🤷🏻♂️ pic.twitter.com/YpbFGxp8WT

— R-MEAN (@rmean) December 21, 2020

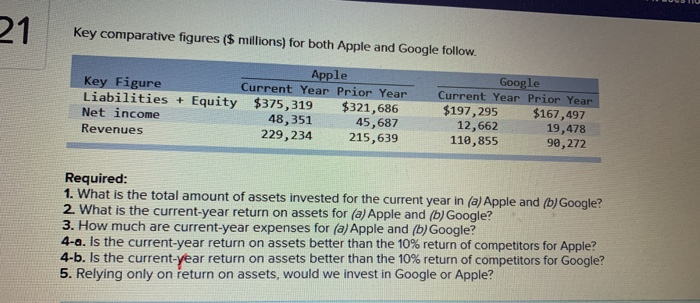

Demystifying Financial Jargon: Understanding’ Net Worth’

In finance, the term‘ Net Worth’ is often used, but what does it mean? Put, net worth is calculated by subtracting total liabilities from total assets. It is an economic measure that signifies the value of an entity, which may be an individual, a corporation, or a country.

Deciphering’ Net Worth’

To begin with, let’s discuss assets. Assets include cash in hand and bank, investments (stocks, bonds, real estate), and personal properties (vehicles, art, jewelry). On the other hand, liabilities, which is the second part of the equation, represent what you owe to others. Liabilities include credit card debt, mortgages, loans, or other outstanding expenses.

Your Net Worth represents the financial health of an individual or business. Lenders use it to evaluate creditworthiness, and financial advisors use it to formulate personal finance strategies.

Factors Influencing Net Worth

Increasing your assets or decreasing your liabilities can enhance your net worth. Although this sounds pretty simple, it involves careful financial planning and wise investment choices. Moreover, unexpected life events and volatile economic conditions can also significantly impact net worth.

- Income: Higher income offers more opportunities to accumulate assets and repay debts, thus increasing your net worth.

- Expenses: Controlling unnecessary expenses can help reduce debt and improve net worth.

- Investment returns: By incrementing your asset pool, successful investments increase your net worth.

The Anatomy of ‘Net Worth’: Assets and Liabilities

Many might scratch their heads when asked, “What does net worth mean?“. Net worth, a concept widely used in finance, is especially crucial when assessing an individual’s or a company’s financial conditions. It is simply the difference between one’s total assets and liabilities.

What are Assets?

Assets can be defined as any property or resource owned by an individual or company that has economic value. These can include real estate properties, bank balances, stocks, bonds, and even personal belongings like cars or jewelry. Assets can be liquid—easily converted into cash, like stocks—or illiquid, like real estate.

Understanding Liabilities

In simplest terms, liabilities are what you owe to others. These could be your mortgage, student loans, credit card debts, or other debt obligations. Liabilities can influence your net worth significantly.

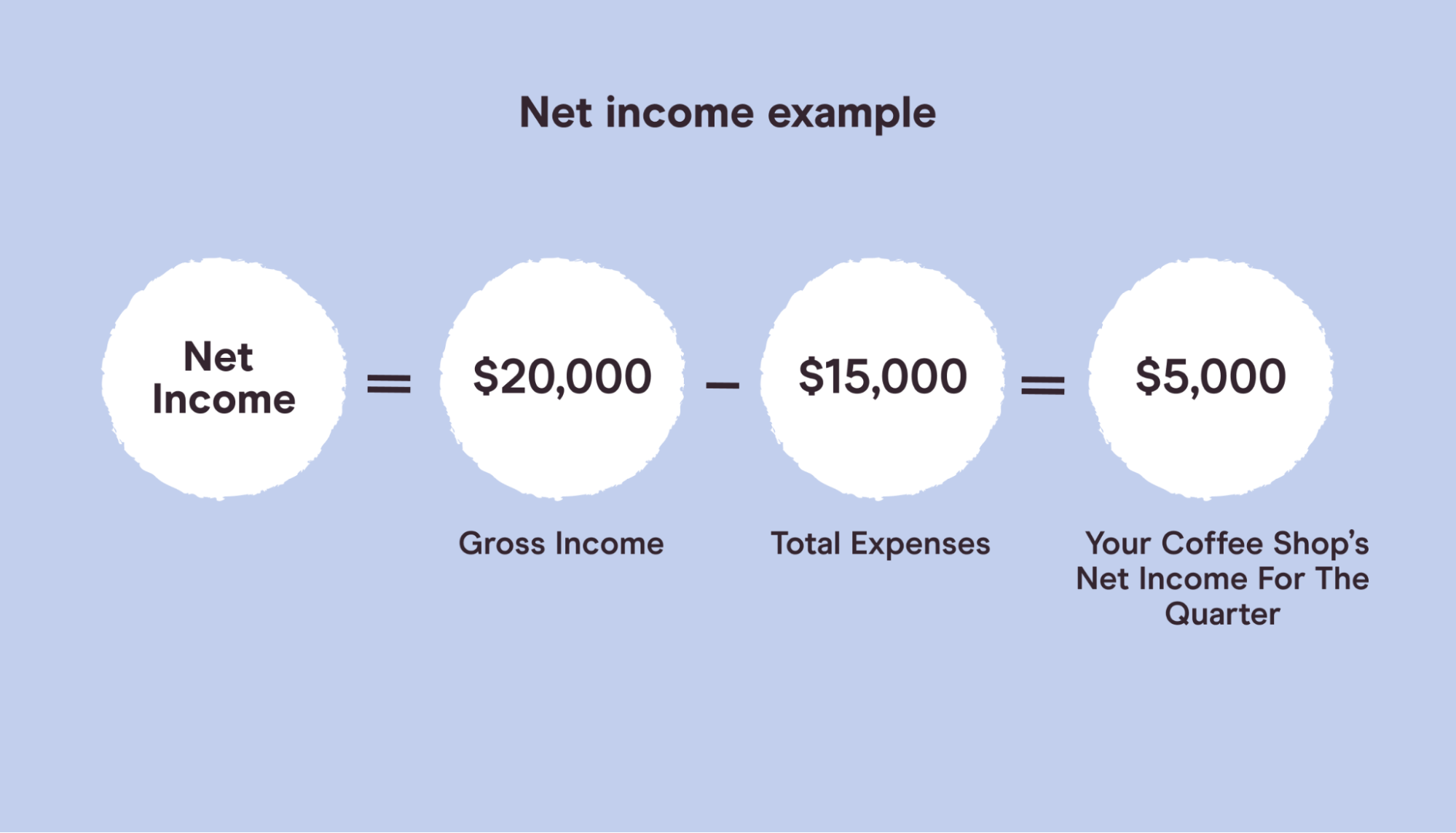

Arriving at Net Worth

You subtract your total liabilities from your total assets to get your net worth. A positive result indicates a positive net worth, suggesting that you have more than you owe financially. Conversely, a negative net worth equates to owing more than you have, presenting potential financial difficulties.

- Net Worth calculation: Net Worth = Total Assets – Total Liabilities

Practical Applications: How is ‘Net Worth’ Calculated?

Essentially, net worth is the comprehensive sum of your assets minus the total of all your liabilities. Considering what does mean ‘net worth’, it encapsulates everything you own of significance (your assets) and subtracts from that the total of what you owe in debts (liabilities).

Steps to Calculate Net Worth

Calculating your net worth isn’t complicated; it simply involves a few steps:

- List your assets: Cash, investments, real estate, vehicles, etc.

- List your liabilities: These could be loans, mortgages, credit card debts, etc.

- Subtract the total liabilities from the total assets: The result is your net worth.

The Importance of Knowing Your Net Worth

Monitoring and understanding your net worth is vital to financial health. This value offers a snapshot of where you stand financially at any given time. By tracking your net worth, you can measure your financial progress, plan for the future, and identify areas for improvement.

Why ‘Net Worth’ Matters: The Relevance in Personal Finance

One important concept to grasp in understanding personal finance is ‘net worth’. So, what does net worth mean? Essentially, it is the total assets a person owns minus the total debts owed. It is a comprehensive snapshot of a person’s financial health at a specific time.

Implications of Net Worth in Personal Finance

Your net worth can greatly impact your financial decisions. A positive net worth indicates that you have more assets than debts, which means you have a stable financial position.

Significantly, it can affect how lenders view your creditworthiness, your opportunity to make investments, and your peace of mind regarding your financial future. In essence, net worth is your financial report card.

The Importance of Tracking Your Net Worth

Regularly assessing your net worth allows you to visualize your financial growth. It can serve as a tool to evaluate your financial strengths, weaknesses, opportunities, and threats.

- Strengths: A steadily growing net worth reflects smart financial decisions and a substantial investment robustlio. This is a sign of financial health.

- Weaknesses: If your net worth is stagnant or decreasing, this allows you to review your spending habits and make changes.

- Opportunities: With a strong net worth, you can take on more investing risks, potentially leading to more significant financial benefits.

- Threats: Conversely, a weak net worth can make one more vulnerable to financial ruin in emergencies.

Impact of ‘Net Worth’ on Your Financial Health

Net worth, an essential factor of financial health, represents an individual’s total wealth. The simple formula assets minus liabilities = net worth is a measuring stick for one’s financial stability. Understanding net worth and its implications is crucial in the modern world.

Net Worth: Foundation of Financial Stability

The ‘net worth’ value is your life’s financial foundation. Whether it’s planning future investments, applying for a loan, or maintaining an emergency fund, your net worth allows you to strategize your way to financial stability. Knowing where you stand financially can give you the confidence and capability to make sound decisions

Let’s look at how the ‘net worth’ affects your financial standing:

- A Positive Net Worth indicates financial health and stability. It signifies that you have more assets than liabilities. It shows that you can meet your financial obligations and still have money left.

- A Negative Net Worth brings worrying signs. It indicates more liabilities than assets and might invite unsavory situations like bankruptcy, arousing the need for debt management.

Improving Your Net Worth

Understanding your net worth is the first step; the next step is improving it. A key focus in improving net worth should be debt management. Making a habit of paying off debts and avoiding unnecessary ones will inevitably increase net worth. Investing assets that ain ppreciate over time, like real estate or precious metals, can also significantly impact your net worth.

Here are some steps to improve your net worth:

- Track your expenses and income.

- Reduce your debts.

- Invest in appreciating assets.

- Create a budget and adhere strictly to it.

- Build an emergency fund.

Exploring Scenarios: Real-Life Examples of ‘Net Worth’

In the world of finance, nothing is as simple or as complex as understanding what net worth is. To uncover this mystery, let’s explore real-life examples that explain the concept better

The Billionaire’s Tale

A prime example is Jeff Bezos, who, according to Forbes 2022, has a net worth of approximately $198.7 billion. This astronomical figure is calculated by adding his assets– like his shares in Amazon, real estate properties, and other investments and then subtracting his liabilities, such as debts.

A key point is that his net worth fluctuates with market conditions and his company’s stock price.

The Middle-Class Family Scenario

On a different level, consider a typical middle-class family. Their net worth would be calculated by summing up their assets, such as their savings, 401(k), equity in their home(s), etc., and then subtracting any outstanding debts, like a mortgage, student loans, etc.

- This is critical for financial planning as it depicts your overall financial health and capacity to weather financial shocks or plan for significant expenditures.

‘Net Worth’ and Businesses: Beyond Personal Finances

Have you ever wondered “what does mean net worth” in businesses? It’s more than just a fiscal snapshot of personal finance. Net Worth in the business context is an important metric that reflects a corporation’s financial health and stability. Simply put, it is the difference between a company’s assets and liabilities.

Understanding ‘Net Worth’ in Businesses

Being a business owner, knowing your company’s net worth gives you a realistic outlook on the business’s value.

Considering the equation Net Worth = Assets – Liabilities, if your company’s assets exceed its liabilities, it has a positive net worth. A negative net worth, however, suggests that liabilities surpass assets, indicating financial distress.

Why is it Essential?

Understanding a business’s net worth is crucial for several reasons. It reflects the company’s financial strength and stability. Furthermore, it helps secure loans, attract investors, and even make strategic business decisions.

- Attracting Investors: Investors always seek profitable and stable businesses in which to invest. A positive net worth indicates a financially strong business, attracting investors.

- Loans: Banks and financial institutions consider a business’s net worth before granting loans. A higher net worth increases the chances of loan approval due to less perceived risk.

Increasing Your ‘Net Worth’: Effective Strategies

Understanding ‘Net Worth’ and working strategically to increase it, is vital for your financial health. The term’ net wort’ to the value of your assets minus any liabilities. Here we will unravel some quick and effective strategies that can help increase your net worth.

Invest Wisely

Investing is a surefire strategy for increasing your net worth. However, it is the art of investing wisely that really makes the difference. If you are a beginner, start with smaller, safer bets, and as you get comfortable, move on to high-risk, high-reward options.

Cut Down Expenses

Another method to improve net worth is cutting down on unnecessary expenditures. Maintain a strict budget and always look for cheaper alternatives before purchasing.

This method helps you save money and indirectly grows your net worth. Here are some suggestions to reduce your expenses:

- Eat in, rather than going out

- Opt for the bus or bike over the taxi

- Buy groceries in bulk

- Avoid wasting utilities

Pay Off Debts

Lastly, try to pay off your debt as swiftly as possible. Debts not only decrease your net worth, but the interest on them can also significantly drain your financial resources. Paying off your debts promptly will give you more freedom to save and invest your money.

Frequently Asked Questions

- What is ‘Net Worth’?

- Net Worth refers to the total value of financial and non-financial assets owned by an individual or company minus the total amounts of liabilities they owe. It indicates a person’s financial health and can be positive or negative.

- How is ‘Net Worth’ calculated?

- Net worth is calculated by subtracting all liabilities (debts) from assets. You will have a positive net worth if your assets exceed your liabilities. Conversely, you’ll have a negative net worth if your liabilities are more significant than your assets.

- Why is understanding ‘Net Worth’ important?

- Understanding your net worth can give a true measure of wealth. It gives you an overview of your financial position and helps you make better financial decisions. It’s a benchmark that can be used to measure financial progress over time.

- Do all assets count towards ‘Net Worth’?

- Yes, all tangible and intangible assets count towards your net worth. These can include cash and cash equivalents, investments, properties, valuable personal belongings, and any business interests.

- Does having a positive ‘Net Worth’ mean you’re wealthy?

- Not necessarily. A positive net worth simply means you own more than you owe. Wealth is subjective and can vary greatly by individual and other factors like age, income level, debts, and financial goals.

Closing Thoughts on Understanding Net Worth

In summing up what net worth means, we encounter a critical tool in financial management. Your net worth is an illustration of your financial health at a given point in time. It’s the sum total of your assets minus your liabilities, providing a snapshot of your financial stability, success, and progress. Knowing your net worth can help steer your financial decisions and plans, safeguarding your economic comfort while preparing for potential adversities. In profound ways, understanding ‘net worth’ is an important step towards suessentialfinancial planning and personal wealth management.