In our journey towards financial literacy, one term often looms large: net worth. But what is a net worth exactly? Why is it something you should be concerned about? This blog aims to unravel the mystery surrounding net worth. We will dive deep into what constitutes net worth, how it can be calculated, and why it is crucial in mapping your financial health and planning your economic future. So whether you’re on the path to financial freedom or just setting out, understanding your net worth can be an invaluable tool for success.

The Evil Genius Net worth is not $5m that’s erroneously disrespectful! please correct yourself before I sue you for defamation!! https://t.co/9WLCaLMHVV

— Don Eazi (@mreazi) October 29, 2023

Understanding the Concept: What is a Net Worth?

As an essential financial term, understanding the concept of ‘net worth” is integral for individuals aiming to manage their financial health effectively. With this in mind, one may ask: What is a net worth?

:max_bytes(150000):strip_icc()/NPV-final-509066b4f3734259a55f52281d155c0b.png)

Definition of Net Worth

Simply put, a person is the difference between their total assets and liabilities. Assets include everything a person owns, which can be converted into cash, whereas liabilities include all outstanding debts and financial obligations that the individual owes.

Determining Net Worth

To determine one’s netone’sh, it’necessarysy to evaluate both the assets and liabilities.

- Calculating Assets: It includes all aindividual’sal estate properties, investments, and other valuables.

- Calculating Liabilities: This encompasses all the money that an individual owes to others, such as mortgage loans, car loans, student loans, and credit card debts.

Once you have determined your assets and liabilities, subtracting your total liabilities from your total assets will reveal your net worth.

The Components of Net Worth: Assets and Liabilities

Understanding the nuances of net worth can be daunting for many. However, breaking it down into its main components, assets, and liabilities, can simplify the concept and answer many questions.

Understanding Assets

Assets are everything that you own that has a monetary value. This typically includes cash, real estate, investments, vehicles, jewelry, etc. In other words, if you can sell it, it’s an it’s for money, it’s an it’s.

Yo, play a crucial role in determining your net worth. The more assets you own, the higher your net worth.

Debunking Liabilities

On the flip side, liabilities are what you owe.

They include mortgages, student loans, credit card debt, and any other financial obligations you must pay. Liabilities dramatically affect your net worth, as what you owe is subtracted from what you own to calculate it.

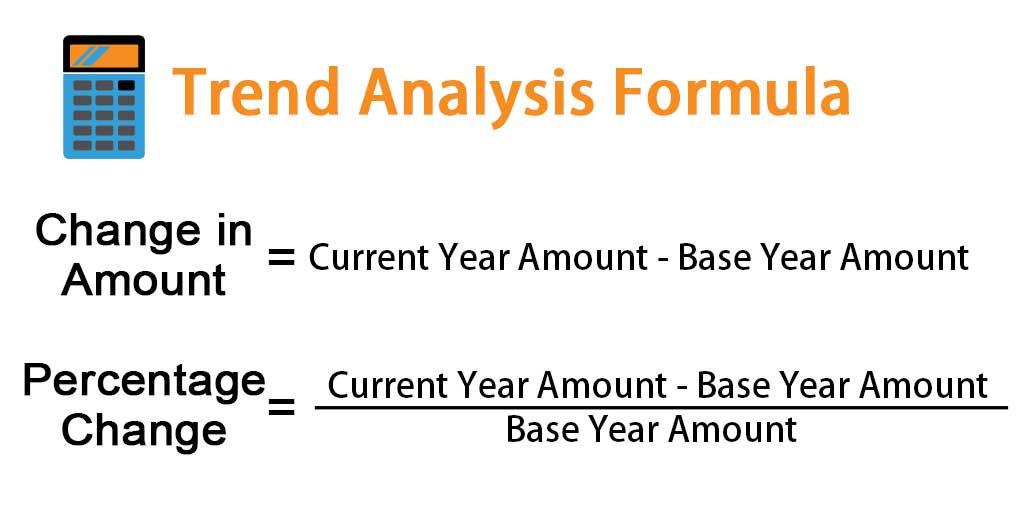

- Net Worth = Assets – Liabilities

Calculating your Net Worth: A Step-by-step Guide

Understanding what net worth can be part of financial health and calculating it doesn’t be a complete step-by-step guide is here to help.

Identify Your Assets

Begin by identifying all your assets. These may include your home, car, savings in the bank, investments, retirement funds, and any valuables such as art, jewelry, etc. Include anything of value that you own outright.

Determine Your Liabilities

Next, compile a list of all your liabilities. These could include mortgage and student loans, credit card debt, and personal loans.

Remember: Net Worth = Assets – Liabilities

Do The Math

Subtract your total liabilities from your assets to calculate your net worth. This calculation will give you a snapshot of your financial health and help you make informed decisions for your future.

- Calculate Total Assets = Sum of all Assets

- Calculate Total Liabilities = Sum of all Liabilities

- Net Worth = Total Assets – Total Liabilities

Importance of Knowing Your Net Worth

Understanding the concept of net worth and knowing your own is crucial for several reasons. Net worth is a measure of your financial health and stability. It lets you track your progress, plan for the future, and make informed financial decisions.

Assessing Financial Health

Your net worth gives a clear snapshot of your financial situation at a particular time. It’s the Difference between Differencewn (assets) and what you owe (liabilities). Hence, a positive net worth indicates that you are financially healthy and vice versa. Your net worth can also be used as a tool to measure your financial progress over time.

Future Planning & Financial Decision Making

Understanding your net worth is an essential first step to future financial planning. Knowing your current financial status helps you plan your finances better, like setting a realistic saving goal or retirement plan. It also leads you to make smart financial decisions.

- It provides a reality check and motivates you to make better financial decisions.

- It helps you identify the areas where you spend too much and where you can save more.

How Net Worth Serves as an Indicator of Financial Health

Net worth is a key measure of financial health. It indicates where you are financially at any point in time, and when tracked over time, it can signal changes in your overall wealth status. Our net worth equals our total assets minus our total liabilities – whenever you want to glimpse ‘what is ‘ net worth’, l’ok at this basic formula.

Assessing Net Worth

You are calculating your net worth isn’just aboutut getting a number. It’about askingng that number and using it to assess where you stand financially. Are you moving towards your goals? Are you veering away from them? The answers lie in the figure that faces you.

Finding out your net worth helps to make a financial situation more quantifiable and understandable. It makes it easier to not only arrange your finances better but also make better financial decisions moving forward.

Net Worth: The Financial Indicator

Your net worth speaks volumes about your financial health. A positive net worth implies that your assets overshoot your liabilities, which is a good sign. On the other hand, a negative net worth might serve as a wake-up call to start addressing your financial situation before it spirals out of control.

- A high net worth signals greater financial stability

- A low or negative net worth could imply excessive debt or a lack of sufficient assets

- The growth of net worth over time can reflect the effectiveness of your investment strategy

Increasing Your Net Worth: Tips and Strategies

If you’re reyou’rethis, you’re wondering about net worth? Simut, your is. Et worth is the value of all your assets minus your liabilities. It tells you exactly where you stand financially at any given moment. Now that we’ve solved the mystery, we’ve solved the let’s strategies for increasing your net worth.

Understanding Your Finances

The first step towards increasing your net worth is understanding your current financial status. This involves examining your income, expenses, assets, and liabilities closely.

Tools like online net worth calculators or budgeting apps can provide a clear overview of your finances. But remember, the accuracy of these tools depends on your honesty and precision.

Increase Income and Decrease Expenses

- Grow your income: This could involve asking for a raise, changing jobs, or even starting a side hustle.

- Minimize Expenses: Look for areas where you can reduce your spending, like subscriptions. Youou aren’aren’t’t dining out too often.

Invest Wisely

Once you’ve invested your income and reduced your expenses, the next step is to invest wisely. Consider diversifying your investments to minimize your risk and increase potential returns.

Be Consistent

You are increasing your net worth doesn’t matter. It requires regular evaluation of your income, expenses, and investments. Most importantly, it requires consistency and patience.

How High Net-Worth Individuals Manage Their Wealth

Understanding one’s netone’sh has become a crucial aspect of modern financial wisdom. It is especially important for high-net-worth individuals (HNWIs), as the management and growth of their wealth depend largely on this understanding.

Investment Strategies

HNWIs diversify their portfolio to include various investments, from traditional stocks and bonds to private equity and real estate investments. This creates a balanced financial plan that can endure market fluctuations.

Creating A Legacy

Many HNWIs are keen on creating a legacy that’ll ethat’llenerations. This often involves careful estate planning and philanthropy. Charitable donations, trusts, and endowments are some methods employed for this purpose.

- Charitable Donations

- Trust Funds

- Endowments

Financial Advisory

HNWIs often rely on a team of trusted financial advisors, including accountants, lawyers, and wealth managers. These experts advise on investments, tax strategies, and overall wealth management.

Frequently Asked Questions

- What is a Net Worth?

- Net Worth is the total value of all your assets after subtracting all your liabilities. In layman’s laym,alalayman’shat you own minus what you owe.

- Why should I care about my Net Worth?

- Your Net Worth offers a snapshot of your financial health. It gives a clear picture of what you own and owe, making it a crucial aspect of your financial planning. It can guide you in making important financial decisions such as saving, investing, or paying down debt.

- How can I calculate my Net Worth?

- To calculate your net worth, first list all your assets, including cash, investments, real estate, and personal property, and then list all your liabilities, such as loans and debts. Subtract the total amount of liabilities from the total amount of assets to get your net worth.

- Does a negative Net Worth mean I’m in financial trouble?

- Not necessarily. A negative Net Worth simply means your liabilities exceed your assets. This could be because of student loans, mortgages, or startup costs for a new business. However, if the negative Net Worth continues for a long period and worsens, it may indicate financial trouble.

- How can I increase my Net Worth?

- There are numerous ways to grow your Net Worth, such as paying off debts, saving more, investing wisely, or increasing your income. Be consistent with these steps, and your net worth will start to grow over time.

- Is a high Net Worth always indicative of wealth?

- Net Worth is one measure of wealth, but it doesn’t tdoesn’t whole stordoesn’ththe Net Worth often indicates a solid financial position. Still, it’s possit’s to have high net worth and low liquidity, making it hard to meet immediate financial obligations. It is important to balance growing net worth with maintaining cash reserves.

Closing Thoughts: Unraveling Your Net Worth

Understanding a net worth can be your stepping stone towards financial literacy. In summary, net worth is a tangible measure of your financial health. It is the value of your assets minus liabilities—a handy benchmark for your financial progress. The insight you gain from calculating and tracking your net worth can inform your spending, saving, and investment patterns. In essence, knowing your net worth is essential to managing your finances. So, start analyzing and monitoring your net worth today, and take control of your economic destiny.