From my latest “What is Liquid Net Worth? [And Why It’s So Important]”https://t.co/fe4zaVZ2ei

— Nick Maggiulli (@dollarsanddata) December 5, 2023

Defining Key Financial Terms: Liquid Net Worth

When you begin your journey toward financial awareness, specific terms frequently come into play. Among them, you may find ‘Liquid Net Worth.’ It’s a term often used, but what does it mean?

Understanding Liquid Net Worth

Liquid Net Worth refers to the total value of your assets that can be quickly converted into cash minus any liabilities. It acts as a critical measure of your financial strength.

It gives insight into your financial stability and how much you would have left if you had immediately paid off all your debts.

Calculating Liquid Net Worth

To calculate Liquid net worth, follow this simple formula: Liquid Assets – Liabilities = Liquid Net Worth. Add up all your liquid assets (which can be turned into cash within a short period, typically 90 days) and subtract any outstanding liabilities.

- Cash and bank balances

- Investments such as stocks, bonds, etc

- Other liquid assets

Now, subtract your liabilities from the total liquid assets; the figure you get is your Liquid Net Worth.

Breaking Down Wealth: Liquid vs. Non-Liquid Assets

When understanding personal wealth, a key concept to grasp is the idea of liquid net worth. But what is liquid net worth? Essentially, your assets’ value can be quickly and easily converted into cash, subtracting your liabilities.

Liquid Assets

Liquid assets can be easily converted into cash without substantially affecting their market value. This includes cash, checking and savings accounts, money markets, and most stocks and bonds.

These assets can be readily accessed in an emergency or for everyday spending. Their liquidity makes them crucial to calculating one’s liquid net worth.

Non-Liquid Assets

Non-liquid assets, on the other hand, cannot be as readily converted into cash. They may take time to sell or may lose value during that process.

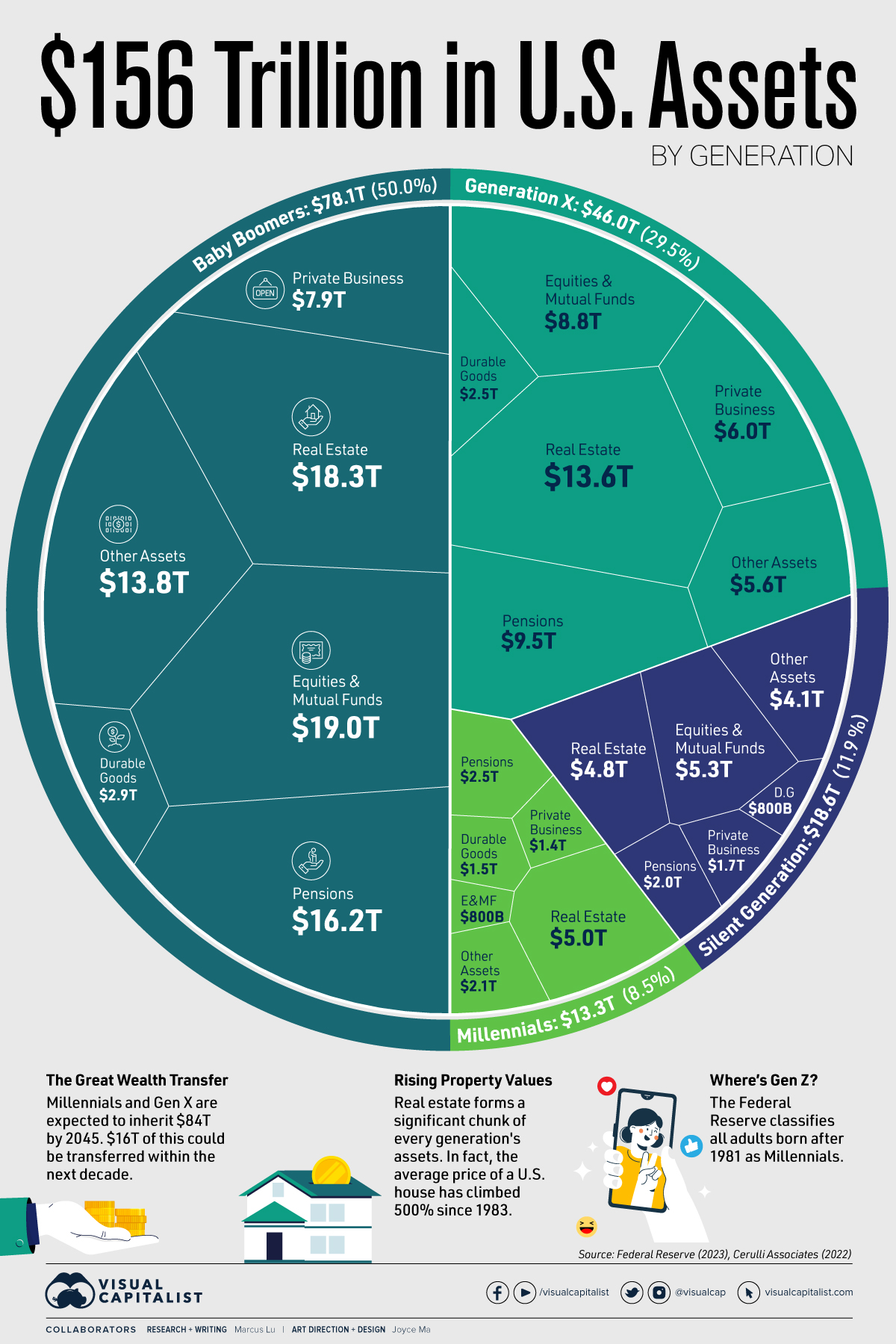

- Real Estate

- Business Ownership

- Various types of collections, like art or coins

Despite their lack of liquidity, these assets are still part of your net worth, not your liquid net worth.

Calculating Your Liquid Net Worth: A Comprehensive Guide

Understanding liquid net worth is essential for your financial planning and immensely beneficial in financial emergencies. The crucial step is knowing how to calculate it.

Determining Your Liquid Assets

Begin with identifying your liquid assets. These are the ones that can be conveniently converted into cash without affecting their market value. Examples include saving accounts, checking accounts, money market funds, stocks, bonds, and mutual funds.

It is essential to remember that not all assets are liquid. For instance, real estate properties, retirement accounts, and non-marketable securities take significant time to sell and usually involve penalties or fees. Hence, they’re considered non-liquid assets.

Subtracting Your Liabilities

Once you have summed up your liquid assets, the next step is to subtract your liabilities. Liabilities are what you owe, including student loans, mortgages, credit card debts, and any other outstanding debts.

- After subtracting liabilities from your total liquid assets, your liquid net worth is the remainder.

Ways to Increase Your Liquid Net Worth

Understanding what is liquid net worth is essential for your financial health. However, learning how to increase it could be an even more significant factor in securing your financial future. Here are some efficient ways to help you raise your liquid net worth.

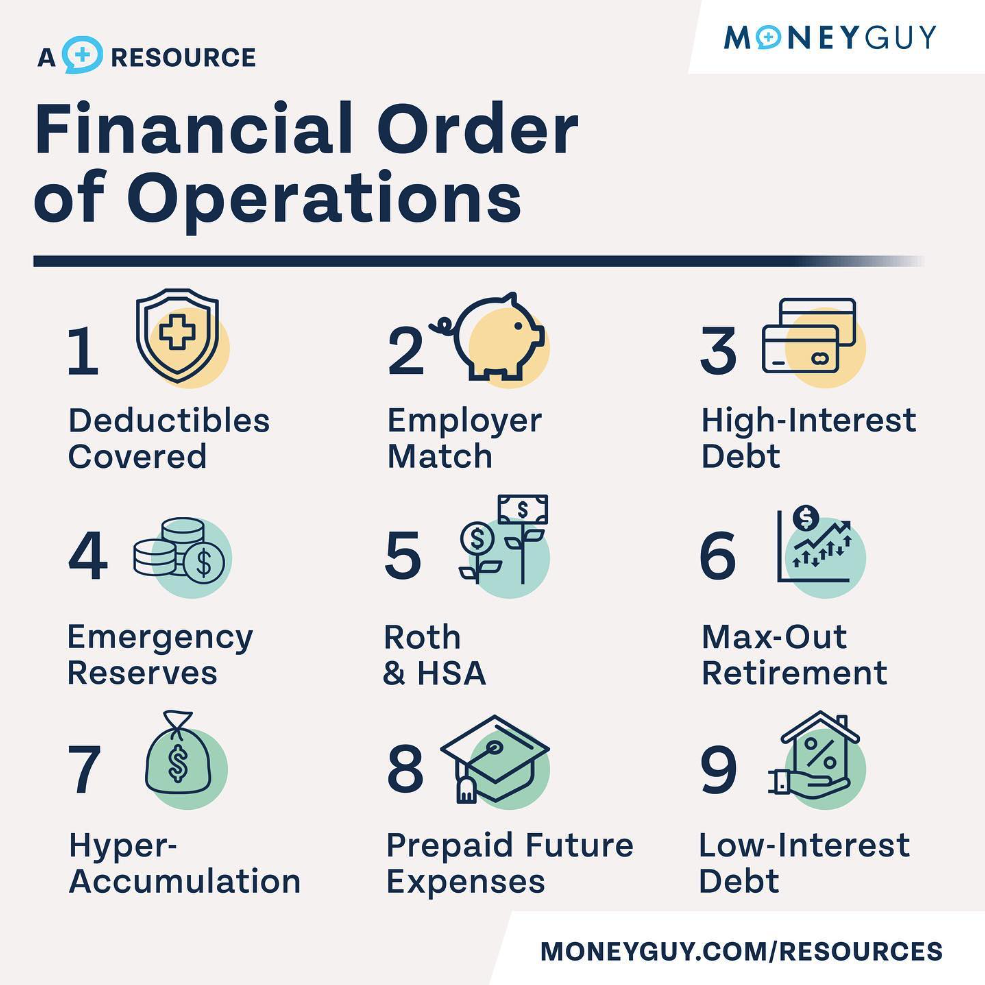

Reducing Debts

The fastest and easiest way to increase your liquid net worth is to reduce your debts. Whether it’s credit card debt, a student loan, or a mortgage, try to minimize it as much as possible. This will not only reduce your liabilities but also increase your net worth.

Debt repayment should be your priority, and once that is clear, your disposable income will increase, eventually increasing your liquid net worth.

Invest In Liquid Assets

Investment is the key to wealth creation. Having your funds tied up in non-liquid assets might increase your net worth but not your liquid net worth. You should invest more in liquid assets to boost your liquid net worth.

- Cash equivalents: These are the most liquid assets, including money market funds, treasury bills, etc.

- Stocks and bonds are relatively liquid and can be quickly sold for cash.

Common Misconceptions About Liquid Net Worth

In personal finance, understanding liquid net worth can be a game-changer. However, the topic is riddled with misconceptions that can cloud your perspective. Let’s debunk some of these myths.

Misconception 1: All Assets are Part of Your Liquid Net Worth

One common misconception is that all assets count towards liquid net worth. While it’s true that your net worth accounts for all of your assets, not all of these assets will be ‘liquid.’ The term liquid refers to assets that can be easily turned into cash without losing significant value.

Misconception 2: Liquid Net Worth is More Important than Net Worth

Another misconception involves the importance of liquid net worth over total net worth. While it’s crucial to have assets that can be quickly converted into cash for emergencies, growing your total net worth over time is equally essential. Think of your liquid net worth as a safety net and your total net worth as the long-term financial goal.

- Liquid Net Worth: Immediate financial safety net

- Total Net Worth: Long-term financial stability and success

Advantages and Disadvantages of Focusing on Liquid Net Worth

When discussing personal finances, a pulsating question often arises: ‘What is liquid net worth?’ Understanding your liquid net worth is important as it provides a snapshot of your financial health at a given moment. However, the implications of focusing heavily on this measure aren’t all rosy. Let’s demystify the advantages and disadvantages of concentrating on liquid net worth.

Advantages of Focusing on Liquid Net Worth

Liquid net worth, in essence, represents the assets you immediately own, which can be converted into cash without any considerable loss of value. It’s a true reflection of your financial agility.

Determining your liquid net worth encourages informed decision-making for immediate investments and financial emergencies.

Disadvantages of Focusing on Liquid Net Worth

Focusing exclusively on liquid net worth may present a skewed view of your financial standing. This is because it exaggerates short-term liquidity risks while understating long-term solvency.

- It doesn’t consider the potential growth rate of non-liquid assets such as real estate or collectibles.

- It can discourage investing in less liquid but potentially more profitable assets.

Real-Life Applications: Why Liquid Net Worth Matters?

Understanding liquid net worth is imperative in today’s fast-paced financial world. As a measure of your financial stability, liquid net worth indicates the total value of your assets that can quickly be converted into cash. In real-life applications, it gives a clear picture of your financial health and ability to weather unexpected financial setbacks. Higher liquid net worth allows for more economic freedom and security.

Planning Your Financial Future

Knowing your liquid net worth can guide your investment strategies and retirement planning. It helps determine how much risk you can afford to take on and the liquidity of your investment portfolio.

Furthermore, it helps with debt management. By understanding your liquid net worth, you can create effective plans to pay off debts without disrupting your daily life.

Weathering Financial Emergencies

Financial emergencies are often unexpected and can come at high costs. A high liquid net worth ensures you have access to funds in such scenarios. It measures the ease of handling an emergency without resorting to loans or credit.

- Liquid net worth determines your eligibility for loans and credit.

- It reflects your financial discipline and has an impact on your credit score.

Frequently Asked Questions

- What is meant by ‘Liquid Net Worth’?

- Liquid net worth is the value of your financial assets that can be quickly and easily converted into cash. This includes checking and savings accounts, stocks, bonds, and other securities. It does not include assets that can’t be quickly sold and converted to cash, like real estate or vehicles.

- How is Liquid Net Worth different from Net Worth?

- While net worth includes all your assets (including those that cannot be quickly converted to cash, like real estate and cars), liquid net worth only includes assets that can be quickly converted to cash.

- How do I calculate my Liquid Net Worth?

- To calculate your liquid net worth, add the total value of all your liquid assets (like cash, savings accounts, and readily tradable securities) and subtract any debts you owe.

- Why is Liquid Net Worth important?

- Knowing your liquid net worth can help you understand how much money you would have access to immediately in case of an emergency or sudden financial need. It also helps in financial planning and investment decisions.

- Does Liquid Net Worth include retirement accounts?

- Yes and no. While retirement accounts can technically be turned into cash, they often come with penalties for early withdrawal, so many financial advisors don’t include them in liquid net worth.

- What can decrease my Liquid Net Worth?

- Your liquid net worth can decrease due to a drop in the value of your liquid assets, such as a drop in stock prices or an increase in your debts or liabilities.

- Can Liquid Net Worth go negative?

- Yes, if your debts’ total value exceeds your liquid assets’ total value, you will have a negative liquid net worth.

Final Thoughts on Liquid Net Worth

To succinctly conclude, ‘what is liquid net worth?’ is a vital financial metric representing your total assets minus liabilities, where the assets can be quickly converted into cash. Calculating your liquid net worth clearly shows your financial health and overall economic stability. Regular monitoring and management of your liquid net worth can steer your financial decision-making process and help you achieve your financial goals more efficiently. Let liquid net worth be your guiding principle towards future monetary security.